No More Tax Deductions for ATO Interest Charges

From 1 July 2025

Starting 1 July 2025, taxpayers will no longer be able to claim income tax deductions for interest charges imposed by the Australian Taxation Office (ATO), including the General Interest Charge (GIC) and Shortfall Interest Charge (SIC). This change was introduced in the 2023–24 Mid-Year Economic and Fiscal Outlook and is now law under the Treasury Laws Amendment (Tax Incentives and Integrity) Act 2025.

What Does This Mean?

Previously, interest incurred on unpaid tax liabilities or amended assessments could be claimed as deductions in your income tax return. From 1 July 2025 onward, any GIC or SIC incurred will no longer be deductible—regardless of whether the debt relates to an earlier income year.

This change applies to individuals, businesses, and entities with substituted accounting periods (SAPs), starting from their next accounting period after 1 July 2025.

Note: The GIC rate currently sits at 10.78% for the July–September 2025 quarter, making tax debts significantly more expensive without the relief of a tax deduction.

What You Can Do

Pay Off ATO Debts Promptly

The most effective way to avoid non-deductible interest is to settle outstanding tax debts before they begin accruing GIC or SIC. This includes GST, PAYG withholding, and income tax obligations. Adjust your cash flow planning to prioritise these payments.

Request Interest Remission

In certain circumstances, you may be eligible to request a remission of interest charges. The ATO considers factors such as whether the delay was beyond your control, if you acted reasonably and in good faith, and whether you’ve made efforts to resolve the debt promptly. If the ATO agrees to remit the interest, and it was previously deductible, the remitted amount must be included in your assessable income in the year of remission.

Why?

This change is part of a broader government push to strengthen tax integrity and discourage the use of the ATO as a source of low-cost credit. In the past, some taxpayers delayed payments knowing that interest charges were tax-deductible. Removing this benefit is intended to encourage more timely compliance and reduce the cost burden on the tax system.

For businesses, especially those with tight cash flow, this could mean rethinking how they manage tax obligations. The cost of delaying payments will now hit harder, and strategic planning around lodgement and payment timing will become even more important.

This a practical example of how policy shifts can influence financial behaviour and planning

Additional Insights

- ATO payment plans still accrue interest. Even if you enter into a payment arrangement, GIC will continue to accrue—now without the benefit of deductibility.

- Consider timing for large assessments. If you anticipate a large tax liability (e.g., from a trust distribution or capital gain), it may be worth pre-paying or lodging early to avoid interest altogether.

- Remission is not automatic. Keep records of any delays or circumstances that may support your case, such as illness, natural disasters, or administrative errors.

This a practical example of how policy shifts can influence financial behaviour and planning.

Further Reading

ATO Reminder on Interest Deductibility Changes from 1 July

For more information, contact La Source Advisory below

Heading

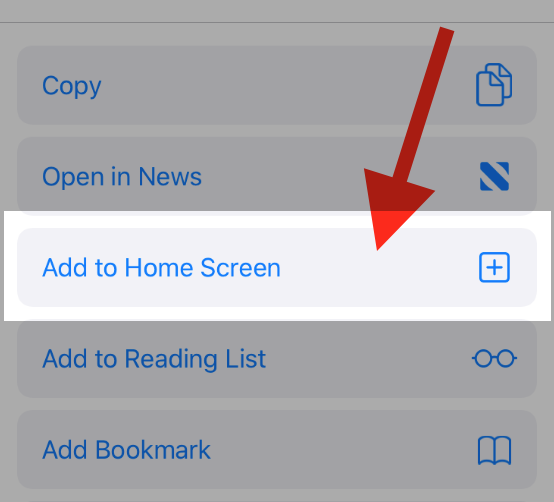

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

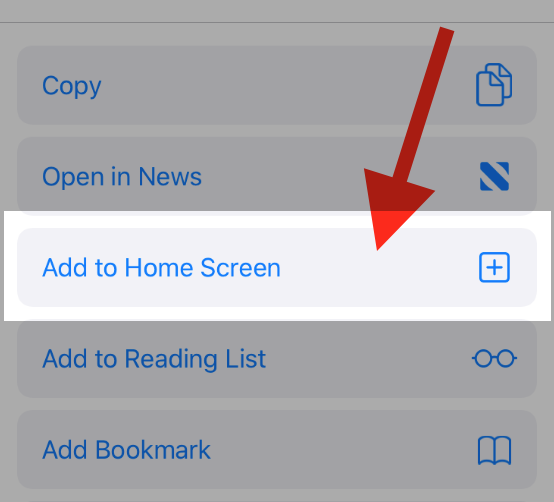

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!