Can I Claim R&D?

If you’ve ever wondered whether your business can claim the Research & Development (R&D) Tax Incentive, you’re not alone. Many small businesses assume R&D is only for big corporations or scientists in lab coats, but that’s not true. The Australian Government designed this program to encourage innovation at all levels, and thousands of SMEs successfully claim it every year.

What is the R&D Tax Incentive?

The R&D Tax Incentive is a federal program that provides a tax offset for companies undertaking eligible R&D activities. It helps reduce the cost and risk of innovation by either:

- Refundable tax offset for companies with turnover under $20 million (often resulting in a cash refund if you’re in a loss position).

- Non-refundable tax offset for larger companies.

This means if you’re developing new products, improving processes, or experimenting with technology, you could qualify.

Who Can Claim?

To be eligible, you must:

- Be an Australian-incorporated company (not a sole trader, partnership, or trust).

- Be liable for income tax in Australia.

- Conduct eligible R&D activities in Australia.

- Spend at least $20,000 on R&D activities in the financial year (unless using a registered Research Service Provider).

What Counts as R&D?

Eligible activities fall into two categories:

1) Core R&D activities: Experimental work where the outcome is unknown and can’t be determined in advance. For example:

- Developing new software or prototypes

- Testing new materials or processes

2) Supporting R&D activities: Activities that directly support your core R&D work. Routine tasks, market research, or minor tweaks generally don’t qualify.

What Expenses Can You Claim?

You can claim costs directly related to R&D, such as:

- Employee salaries for staff working on R&D

- Materials and consumables used in experiments

- Contractor fees for R&D work

- Software and cloud services used for R&D

- A portion of overheads (e.g., rent for lab space)

How Much Can You Get Back?

For small businesses (turnover under $20M):

Refundable tax offset = your corporate tax rate + 18.5% premium

Example: If your company tax rate is 25%, your R&D offset is 43.5%.

How to Claim

- Register your R&D activities with AusIndustry within 10 months of year-end.

- Keep detailed records - project plans, timesheets, invoices, test results.

- Lodge the R&D schedule with your company tax return.

What if you get this wrong?

The R&D Tax Incentive is a self-assessment program, which means you’re responsible for ensuring your claim is correct. Getting it wrong can have serious consequences:

- Repayment of the refund or offset if your activities are found ineligible.

- Penalties and interest for false or misleading claims.

- Audit risk - poor documentation or inflated claims can trigger a review.

- Cash flow impact if you’ve relied on the refund for funding.

Because the rules are complex and eligibility depends on strict definitions, it’s critical to seek specialist advice. An experienced R&D tax adviser can help you:

- Confirm eligibility before you spend.

- Prepare compliant documentation.

- Maximise your claim without risking penalties.

Eligibility depends on the precise nature of the activities undertaken and how they are conducted and documented, not merely on the end product or commercial outcome.

Disclaimer: This is general information only and does not consider your specific circumstances. Always seek professional advice before making decisions

Heading

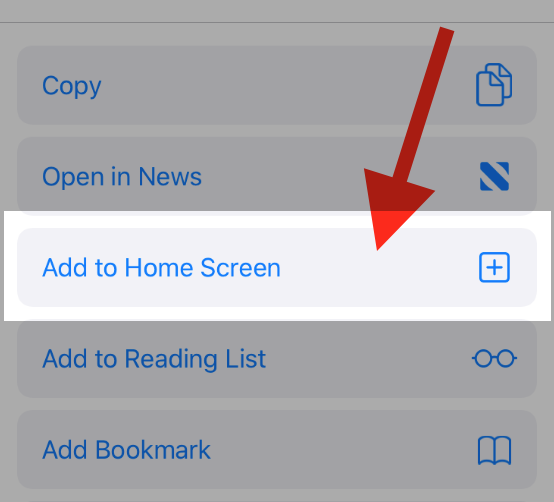

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

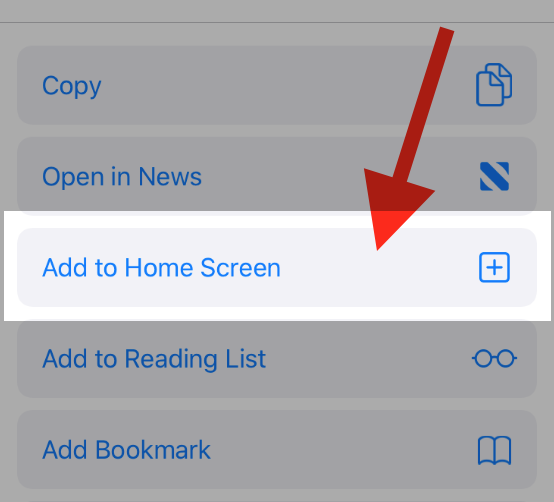

To add this web app to your homescreen, click on the "Share" icon

![]()

Then click on "Add to Home"

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!

It looks like your browser doesn't natively support "Add To Homescreen", or you have disabled it (or maybe you have already added this web app to your applications?)

In any case, please check your browser options and information, thanks!